Written by Terrence Lundin, Senior Financial Consultant at Edgewater Associates

It’s been over 6 years since I secured the above for myself and I’ve been fortunate enough to assist many people, not just clients, over the years in securing a better retirement for themselves and their families/friends.

Given the above deadline and the very limited time I have available to assist more people, I have created this step-by-step guide. Please “Share” this article so friends, family and colleagues can also benefit from this.

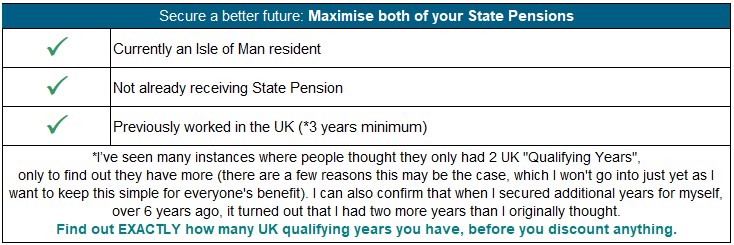

This article is for Isle of Man residents who can tick all three of the below:

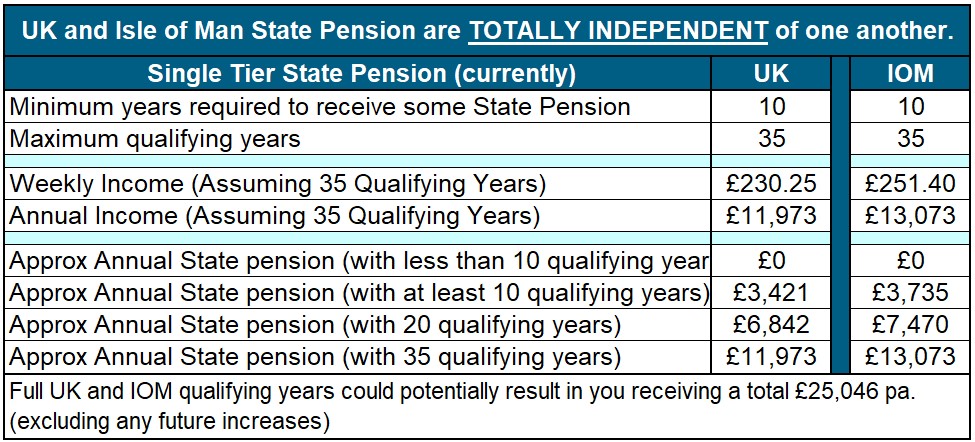

The UK and Isle of Man State Pensions are totally independent from each other, although both are payable when you reach State Pension Age (“SPA”), which, depending on your date of birth is currently between age 66 and 68 (www.gov.uk/state-pension-age). Each of these state pensions depends on how many qualifying years you obtain before “SPA”, in each independent jurisdiction, as demonstrated below:

Ordinarily, HMRC only permits you to purchase the last 6 since years of “gap” years in your National Insurance record. Until 5th April 2025, HMRC is permitting you to purchase any gap years you have, all the way back to 2006/7.

You could therefore potentially increase your UK State Pension by purchasing:

- Up to 18 additional qualifying years, as a Lump Sum payment.

- Plus, additional qualifying years by Direct Debit.

Both of the above could potentially be at very favourable rates Class 2 NI rates. Whilst Class 2 NI rates are usually only for self employed individuals, given the agreements between the UK and the Isle of Man, you should, as long as you’ve paid/are paying Isle of Man National Insurance, be able to benefit from these rates.

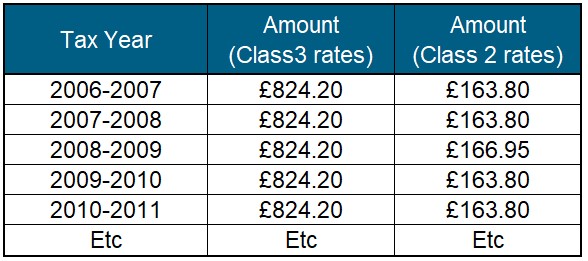

For any years that you were not, or will not, be paying Isle of Man National Insurance, you could still purchase Lump Sum and ongoing Direct Debit payments, albeit at Class 3 rates. Whilst Class 3 rates are less favourable (than Class 2 rates), I will show you why, subject to affordability, this is still potentially a very good thing to do, despite not being as economical.

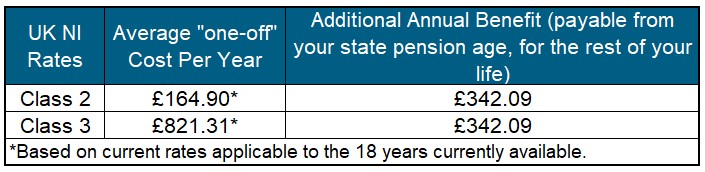

Simplified Benefit Analysis:

In today’s money, EACH additional UK Qualifying Year purchased, could be summarised in the below table:

Feel free to skip the next section “Technical Benefit Analysis” below, which will assess the potential longer-term benefits, evidencing just how important it is to take advantage of the Class 2 NI rates before this opportunity expires (5th April 2025).

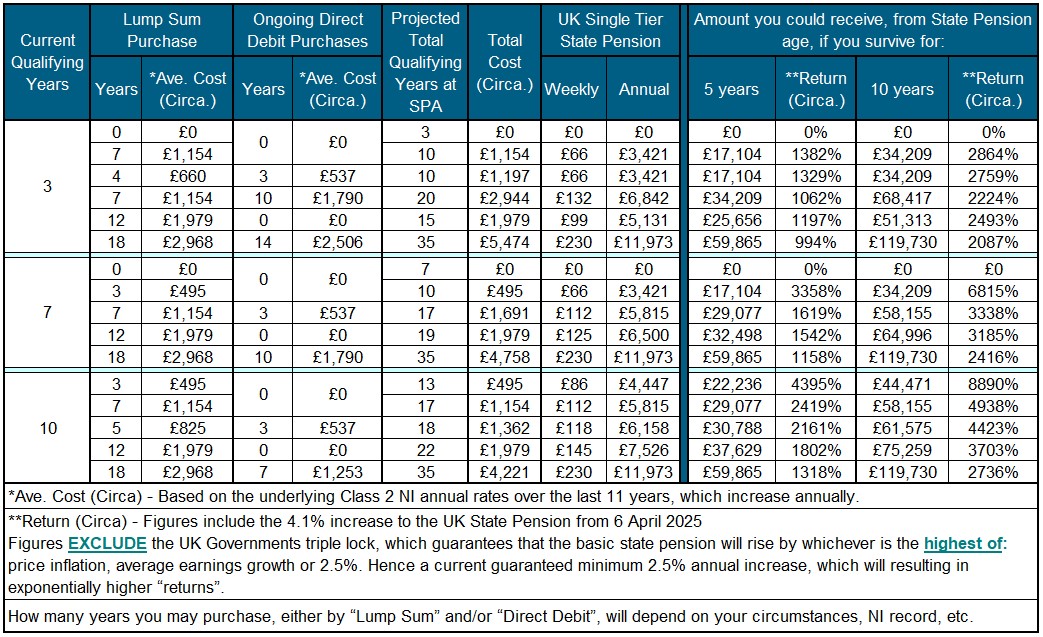

Technical Benefit Analysis:

The examples in the below table are not specific to you, nor your National Insurance Record, however should give you a good understanding of the levels of returns/benefits you would miss out on, if you chose to prioritise other things:

The possible scenarios or combinations are almost endless, but it’s fair to say that if you live for at least 1 year after SPA you (and your family) should benefit, to what extent will obviously depend on how long you live for after “SPA”.

WARNING: You cannot purchase additional voluntary National Insurance Qualifying Years in the Isle of Man and UK for the same years; so please choose wisely before making any decisions.

ACTIONS:

- Download and print the form “CF83 - Application to pay voluntary National Insurance contributions abroad”

the link is https://assets.publishing.service.gov.uk/media/65a4e2117eb42e000dceb7ab/CF83.pdf

- Complete the CF83 form

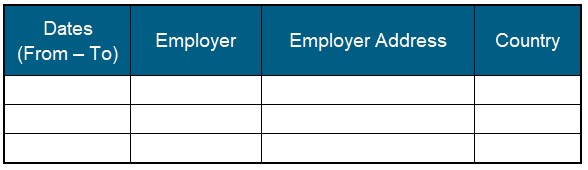

Regarding point 14: “a” is the direct debit, “b” is the Lump Sum and “c” is for both. You may have 25 qualifying years and therefore only need 10 more years to achieve the full 35 Qualifying Years in order to be eligible to receive a full UK State Pension, and therefore the Direct Debit ongoing payments would not be required. - Complete a cover letter which clearly reflects your CV, this is important as they are likely to ask for this given the current form does not enable to confirm your employment history and eligibility to either class 2 or Class 3 rates, suggested table below:

- Copy the completed form & Cover letter (for your records)

- TRACKED & SIGNED FOR POSTAGE: Send the form and your cover letter to the address on the CF83 form (as detailed below the “Declaration”/signature section on the last page).

- Add a note in your mobile phones calendar “HMRC form sent”

- Add a note in your mobile phones calendar in approximately 6 months’ time “HMRC response expected” (they are currently working on a backlog, which may increase given the expected influx of applications in the run up to the deadline.

- In about out 6 months’ time, the Centre for Non-Residents team and an International Caseworker will write to you confirming how many UK qualifying years you currently have and whether or not they have accepted your application to pay Class 2 rates.

- The letter will also have a table of all your “GAP” years, which are all the years you can purchase as a lump sum payment, and the rates/cost applicable (Typically these years are 2006/7 to present):

- Assess your options before purchasing any additional qualifying years in either jurisdiction, ensuring that you will, at least, achieve a minimum of 10 Qualifying Years (Minimum years required to receive some State Pension). Feel free to contact me when you have HMRC’s response letter.

- Prepare to make the payment.

Every year the Direct Debit rates go up, so the cost will be more expensive. Legislation may also change, which may prevent you from adding any qualifying years in the future. You may therefore choose to secure as many “Lump Sum” years as possible (subject to affordability). You can decide how many Lump Sum years you will be purchasing, as you don’t need to purchase all of them,If you can only afford to purchase some of the tabled years that are available, always opt to pay the “oldest years” first. After the 6th April 2025, you will only be eligible to purchase the previous 6 years (not the current 18 years as is now the case).

Purchase the additional qualifying years by lump sum payment. HMRC’s response letter will tell you where the payment details can be located and this will include the payment reference number you should use.

IMPORTANT: To ensure your payment is allocated correctly, I strongly suggest you review the example provided on the website.

- If you are NOT purchasing all the available Lump Sum “Gap” years, you can still make the payment as above for the years you wish to secure. You will however need to send a letter (to the same address on the CF83 form), confirming which years you have chosen to purchase, the date the payment was made and the payment reference number used as per detailed above.

- It could take a further 6 month or more for your UK NI Record and State Pension forecast to be updated to reflect the additional years you purchased. You should register on the UK Government Gateway Register for HMRC online access - link here ( www.gov.uk/log-in-register-hmrc-online-services/register )

- Once you have registered you can log into the UK Government Gateway, use the magnifying glass/search function and look for: “Check National Insurance Record” or “Check State Pension Forecast”.

-

Check your National Insurance Record and State Pension (as above) annually, to ensure account reflects correctly (especially if you are making ongoing Direct Debit payments). Unless legislation changes, you could stop the Direct Debit when you reach 35 full qualifying years required, as your pension will not increase with any more Qualifying years.

However, please note that legislation could change. If it does you may need more than 35 years, in which case it would be best to continue the Direct Debit.

- Please “Share” this article so friends, family and colleagues can also benefit from this.

- “Connect with me” on linkedin.com/terrencelundin to ensure you don’t miss any similar articles, and or further updates.

The examples in the tables are not specific to you, nor your National Insurance Record. This article is not a personal recommendation nor financial promotion. The generic information contained in this article is for guidance purposes only. The content of this article is believed to be correct at the time of going to press but cannot be guaranteed.